AIM students team up with Big Shoulders Fund to teach advanced investing skills to high schoolers.

By Jennifer Walter, Comm ’19

How old were you when you first learned about the stock market? For many teens, investment education is nonexistent. Students from Marquette’s Applied Investment Management program wanted to change that fate for a group of early high schoolers who were eager for an opportunity to dive into the world of investing.

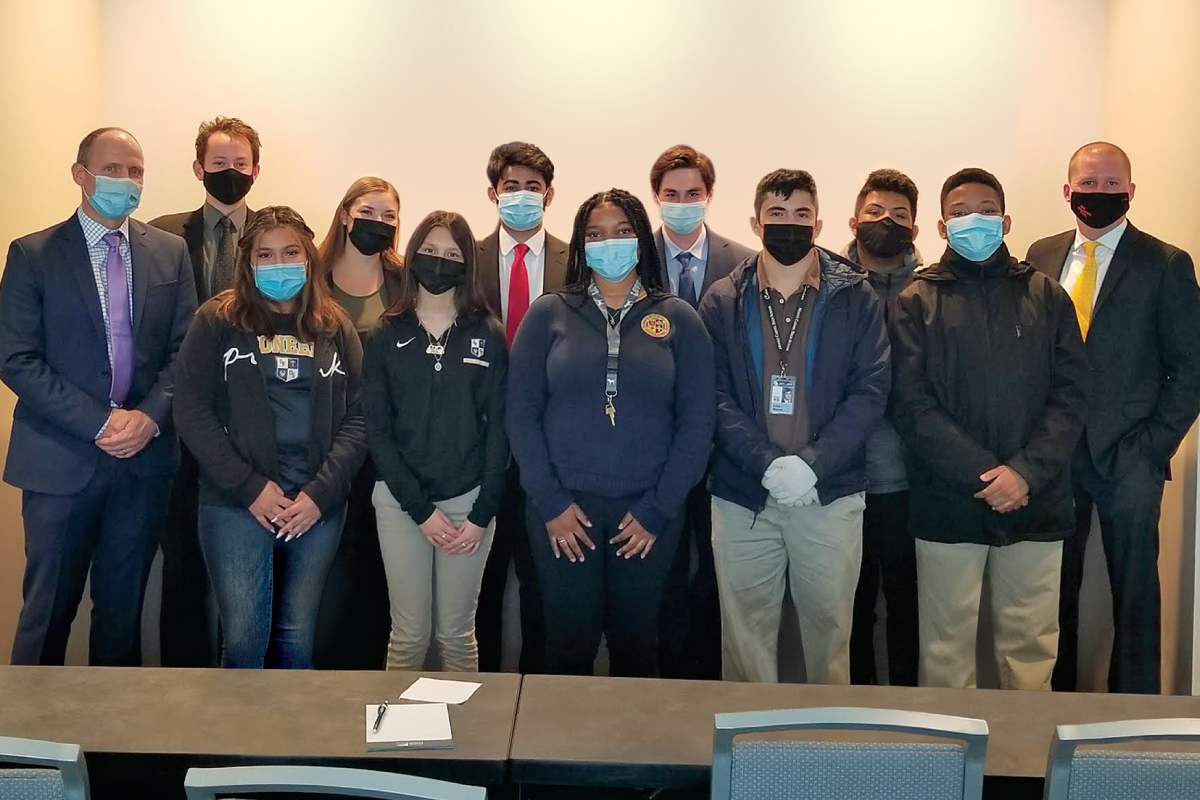

Through a partnership with the nonprofit Big Shoulders Fund, six AIM seniors shaped a new curriculum and taught weekly lessons to students during the fall 2021 semester. Called the Accelerated Stock Market Program, it ran for six weeks with an initial cohort of 16 high schoolers from 11 Chicago-area schools.

“One of the things that we’ve learned along the way in launching and piloting programs is to start small,” explains Tim Liston, Comm ’08, director of donor engagement and partnerships at Big Shoulders Fund, which supports Chicago schools that demonstrate need and provide a values-based education. Liston hopes to see the program, initially limited to just over a dozen participants, expand in the coming semesters.

The accelerated program builds on a yearlong Big Shoulders curriculum on the stock market that has been taught to eighth graders in all 61 elementary schools in its network for almost 15 years. It caters to high schoolers who crave a continued learning experience — and that’s where the AIM students step in.

Rishi Kumar, Bus Ad ’22, was one of the students to pilot the first Accelerated Stock Market Program. Over Zoom, he walked students through the stock screening process and explained his thought process for choosing which companies to invest in.

Learning how to frame the lessons for enthusiastic high schoolers wasn’t always easy, Kumar says. “These kids aren’t Warren Buffett, right? They’re high schoolers.” So the challenge was to find a balance of keeping it simple while still engaging the students in meaningful conversations.

They even touched on contemporary topics like ESG investing, which explores the environmental and social impacts of adding certain stocks to your portfolio. Throughout the program, Kumar was often impressed by how bright and engaged students were with the lessons. “It was kind of eye-opening, because I definitely wasn’t at this point when I was their age,” he says.

In addition to the wealth of investment knowledge that students gain, the program itself is an investment of sorts, too. With the program continuing in 2022 and beyond, Chicago-area students from under-resourced communities have a chance to spark a future career in investing, learning from peers less than a decade older than them.

“The hope is that we can continue to funnel and build that pipeline of future finance leaders,” Liston says.